UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ | | | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

5 ☐ | | | Preliminary Proxy Statement |

☐ | | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | | | Definitive Proxy Statement |

☐ | | | Definitive Additional Materials |

☐ | | | Soliciting Material under § 240.14a-12 |

PYXIS ONCOLOGY, INC. (Name of Registrant as Specified in its Charter) |

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ | | | No fee required. |

☐ | | | Fee paid previously with preliminary materials. |

☐ | | | Fee computed on table in exhibit required per Exchange Act Rules 14a-6(i)(1) and 0-11. |

PYXIS ONCOLOGY, INC.

321 Harrison Avenue

Boston, Massachusetts 02118

NOTICE OF THE 20232024 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 13, 202311, 2024

DEAR STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that the 2023 annual meeting2024 Annual Meeting of stockholdersStockholders (the “Annual Meeting”) of Pyxis Oncology, Inc., a Delaware corporation, will be held on June 13, 2023,11, 2024, at 10:00 a.m. Eastern Standard Time in a virtual meeting format only. We believe hosting a virtual meeting enables participation by more of our stockholders, while lowering the cost of conducting the meeting. Stockholders attending the virtual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting. We encourage you to attend online and participate. In order to attend the annual meeting,Annual Meeting, you must register at www.proxydocs.com/PYXS. Upon completing your registration, you will receive further instructions via email, including a unique link that will allow you access to the annual meetingAnnual Meeting and to vote and submit questions during the annual meeting.Annual Meeting. We recommend that you log in a few minutes before 10:00 a.m., Eastern Standard Time, on June 13, 202311, 2024 to ensure you are logged in when the annual meetingAnnual Meeting begins.

During the annual meeting,Annual Meeting, stockholders will be asked to consider the following matters, as more fully described in the proxy statement accompanying this notice:

1. | the election of one Class I director and |

2. | the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, |

3. | the transaction of such other business as may properly come before the meeting, or any adjournment or postponement thereof. |

These items of business are more fully described in the Proxy Statementproxy statement accompanying this Notice.notice.

Stockholders of record at the close of business on April 20, 202318, 2024 are entitled to notice of, and to vote at, the annual meetingAnnual Meeting and any adjournment or postponement thereof. All stockholders are cordially invited to attend the meeting.

YOUR VOTE IS IMPORTANT.

You may cast your vote over the Internet, by telephone, or by completing and mailing a proxy card. Returning the proxy does not deprive you of your right to attend the annual meetingAnnual Meeting and to vote your shares in person virtually. Proxies forwarded by or for banks, brokers or other nominees should be returned as requested by them. We encourage you to vote promptly to ensure your vote is represented at the annual meeting,Annual Meeting, regardless of whether you plan to attend.

You can find detailed information regarding voting in the section entitledtitled “General Information” on pages 1 through 5 of the accompanying proxy statement.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 13, 202311, 2024

The notice of the annual meeting,Annual Meeting, proxy statement and the Company’s Annual Report

on Form 10-K for the fiscal year ended December 31, 2022,2023, are available at www.proxydocs.com/PYXS.

You will be asked to enter the control number located on your proxy card or Notice of Internet

Availability of Proxy Materials to access the Company’s materials and vote through www.proxydocs.com/PYXS.

|

|

| BY ORDER OF THE BOARD OF DIRECTORS |

| | | |

| | Lara Sullivan, M.D. President and Chief Executive Officer |

Boston, Massachusetts

April 28, 202326, 2024

TABLE OF CONTENTS

| | 1 | |

PROPOSAL ONE: ELECTION OF ONE CLASS I DIRECTOR AND THREE CLASS | | | 6 |

|

|

| |

|

|

| |

|

|

| |

| |

| |

|

|

| |

|

|

| |

|

|

| |

| |||

10 | |||

|

|

| |

|

|

| |

| |||

| |||

| |||

| |||

|

|

| |

|

|

| |

|

|

| |

| |||

|

|

| |

| |

| |

| |||

| |||

| |||

16 | |||

| | 17 | |

| |||

| |||

| |

| |

| |||

|

| |||

| |||

| |||

|

| ||

| |||

| |||

| |

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

|

|

|

| |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | |

|

| |

| |

|

|

| |

|

|

|

PYXIS ONCOLOGY, INC.

321 Harrison Avenue

Boston, Massachusetts 02118

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 13, 202311, 2024

PROXY STATEMENT

GENERAL INFORMATION

This proxy statement is furnished to stockholders of Pyxis Oncology, Inc. (“we,” “us,” “our,” the “Company” or “Pyxis Oncology”), a Delaware corporation, in connection with the solicitation of proxies by our board of directors (the “Board”) for use at our 2023 annual meeting2024 Annual Meeting of stockholders to be held on June 13, 2023,11, 2024 (the “Annual Meeting”), and at any adjournment or postponement thereof. The annual meetingAnnual Meeting will be held at 10:00 a.m. Eastern Standard Time in a virtual meeting format. In order to attend the annual meeting,Annual Meeting, you must register at www.proxydocs.com/PYXS. Upon completing your registration, you will receive further instructions via email, including a unique link that will allow you access to the annual meetingAnnual Meeting and to vote and submit questions during the annual meeting.Annual Meeting.

As permitted by the rules of the U.S. Securities and Exchange Commission (the “SEC”), we are making this proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 20222023 available to our stockholders electronically via the Internet at www.proxydocs.com/PYXS. You will be asked to enter the control number located on your proxy card or Notice of Internet Availability of Proxy Materials (“Internet Notice”). On or about May 2, 2023,2024, we will mail to our stockholders the Internet Notice, containing instructions on how to access this proxy statement and vote online or by telephone. If you received an Internet Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you specifically request them pursuant to the instructions provided in the Internet Notice. The Internet Notice instructs you on how to access and review all of the important information contained in this proxy statement.

Please note that references to our website herein do not constitute incorporation by reference of the information contained at or available through our website.

Why am I receiving these materials?

We are distributing our proxy materials because our board of directorsBoard is soliciting your proxy to vote at the annual meeting.Annual Meeting. This proxy statement summarizes the information you need to vote at the annual meeting.Annual Meeting. You do not need to attend the annual meetingAnnual Meeting to vote your shares.

Pursuant to SEC rules, we are providing access to our proxy materials via the Internet. Accordingly, we are sending an Internet Notice to all of our stockholders as of the record date. All stockholders may access our proxy materials on the website referred to in the Internet Notice. You may also request to receive a printed set of the proxy materials. You can find instructions regarding how to access our proxy materials via the Internet and how to request a printed copy in the Internet Notice. Additionally, by following the instructions in the Internet Notice, you may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. We believe that these rules allow us to provide our stockholders with the information they need while lowering the costs of delivery and reducing the environmental impact of the annual meeting.Annual Meeting.

1

What proposals will be voted on at the annual meetingAnnual Meeting and how does the board of directorsBoard recommend that stockholders vote on the proposals?

The proposals to be voted on at the annual meetingAnnual Meeting and the board of directorsBoard recommendation on each proposal is set forth below:

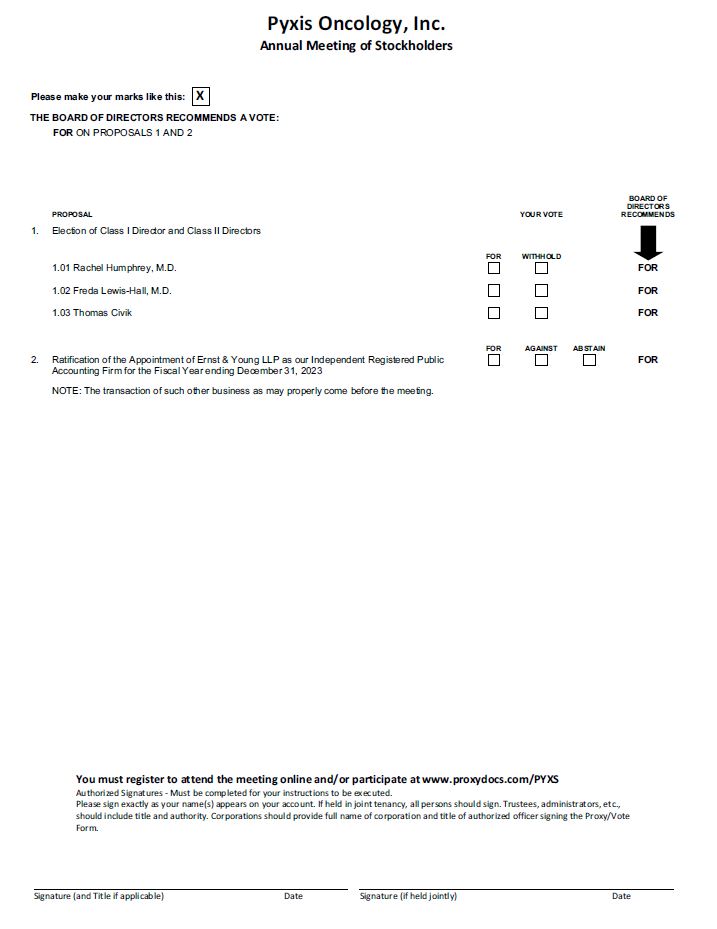

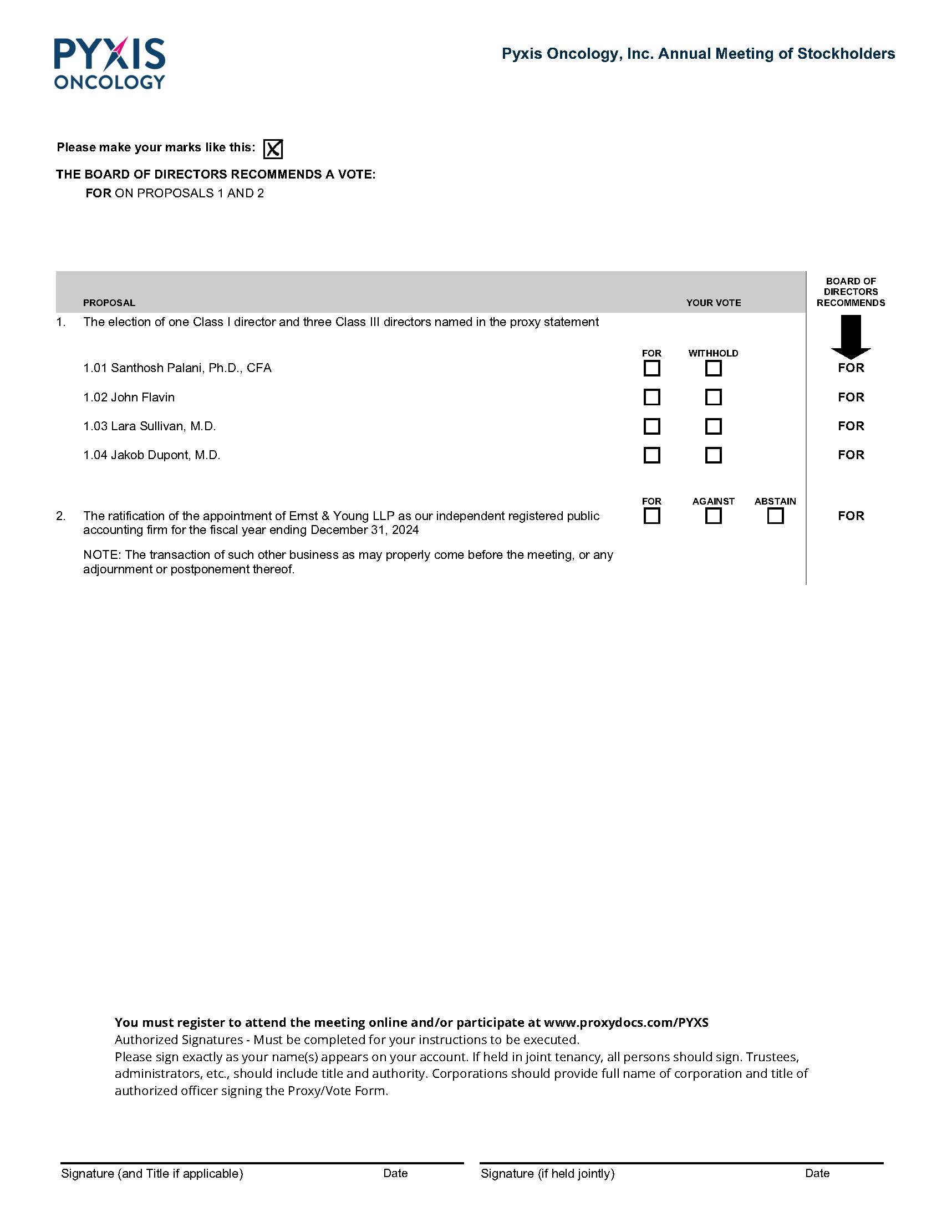

• | “FOR” Proposal One – the Election of |

• | “FOR” Proposal Two – Ratification of the Appointment of Ernst & Young LLP as our Independent Registered Public Accounting Firm for the Fiscal Year ending December 31, |

We will also consider other business, if any, that properly comes before the annual meeting.Annual Meeting.

Who is entitled to vote?

The record date for the annual meetingAnnual Meeting is the close of business on April 20, 2023.18, 2024. As of the record date, 37,984,18758,876,390 shares of our common stock, par value $0.001 per share, were outstanding. Only holders of record of our common stock as of the record date will be entitled to notice of and to vote at the annual meetingAnnual Meeting or any adjournment or postponement thereof. Each stockholder is entitled to one vote for each share of our common stock held by such stockholder on the record date.

What do I need for admission to the annual meeting?Annual Meeting?

In order to attend the annual meeting,Annual Meeting, you must register at www.proxydocs.com/PYXS. Upon completing your registration, you will receive further instructions via email, including a unique link that will allow you access to the annual meetingAnnual Meeting and to vote and submit questions during the annual meeting.Annual Meeting. You will not be able to attend the annual meetingAnnual Meeting physically in person.

As part of the registration process, you must enter the control number located on your proxy card, voting instruction form, or Internet Notice. If you are a beneficial owner of shares registered in the name of a broker, bank or other nominee, you will also need to provide the registered name on your account and the name of your broker, bank or other nominee as part of the registration process.

On the day of the annual meeting,Annual Meeting, stockholders may begin to log in to the meeting 15 minutes prior to the start time. The annual meetingAnnual Meeting will begin promptly at 10:00 a.m. Eastern Standard Time on June 13, 2023.11, 2024.

We will have technicians ready to assist you with any technical difficulties you may have accessing the annual meeting.Annual Meeting. If you encounter any difficulties accessing the virtual-only annual meetingAnnual Meeting platform, including any difficulties voting or submitting questions, you may call the technical support number that will be posted in your instructional email.

Can I ask questions during the annual meeting?Annual Meeting?

Our virtual annual meetingAnnual Meeting will allow stockholders to submit questions before and during the annual meeting.Annual Meeting. During a designated question and answer period at the annual meeting,Annual Meeting, we will respond to appropriate questions submitted by stockholders. If you would like to submit a question during the annual meeting,Annual Meeting, you may log in to www.proxydocs.com/PYXS using your control number, type your question into the “Ask a Question” field, and click “Submit.”

We will answer as many stockholder-submitted questions as time permits, and any questions that we are unable to address during the annual meetingAnnual Meeting will be answered following the meeting, with the exception of any questions that are irrelevant to the purpose of the annual meetingAnnual Meeting or our business or that contain inappropriate or derogatory references which are not in good taste. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition.

2

How can I vote my shares?

Shares Held of Record. If you hold your shares in your own name as a holder of record, you may authorize that your shares be voted at the annual meetingAnnual Meeting in one of the following ways:

By Internet | If you received the Internet Notice or a printed copy of the proxy materials, follow the instructions in the Internet Notice or on the proxy card. |

By Telephone | If you received a printed copy of the proxy materials, follow the instructions on the proxy card. |

By Mail | If you received a printed copy of the proxy materials, complete, sign, date, and mail your proxy card in the enclosed, postage-prepaid envelope. |

In Person (Virtual) | You may also vote in person virtually by attending the meeting through www.proxydocs.com/PYXS. To attend the |

Shares Held in Street Name. If you hold your shares through a broker, bank or other nominee (that is, in street name), you will receive instructions from your broker, bank or nominee that you must follow in order to submit your voting instructions and have your shares voted at the annual meeting.Annual Meeting. If you want to vote in person virtually at the annual meeting,Annual Meeting, you must register in advance at www.proxydocs.com/PYXS. You may be instructed to obtain a legal proxy from your broker, bank or other nominee and to submit a copy in advance of the meeting. Further instructions will be provided to you as part of your registration process.

Even if you plan to attend the annual meeting,Annual Meeting, we recommend that you submit your proxy or voting instructions in advance of the annual meetingAnnual Meeting as described above so that your vote will be counted if you later decide not to attend or are unable to attend the annual meeting.Annual Meeting.

Can I change my vote or revoke my proxy?

You may change your vote or revoke your proxy at any time before it is voted at the annual meeting.Annual Meeting. If you are a stockholder of record, you may change your vote or revoke your proxy by:

• | delivering to us (Attention: Corporate Secretary) at the address on the first page of this proxy statement a written notice of revocation of your proxy; |

• | delivering to us an authorized proxy bearing a later date (including a proxy over the Internet or by telephone); or |

• | attending the |

Attendance at the annual meetingAnnual Meeting will not, by itself, revoke a proxy.

If your shares are held in the name of a bank, broker or other nominee, you may change your vote by submitting new voting instructions to your bank, broker or other nominee. Please note that if your shares are held of record by a bank, broker or other nominee, and you decide to attend and vote at the annual meeting,Annual Meeting, your vote at the annual meetingAnnual Meeting will not be effective unless you present a legal proxy, issued in your name from the record holder (your bank, broker or other nominee).

3

What is a broker non-vote?

Brokers, banks or other nominees holding shares on behalf of a beneficial owner may vote those shares in their discretion on certain “routine” matters even if they do not receive timely voting instructions from the beneficial owner. With respect to “non-routine” matters, the broker, bank or other nominee is not permitted to vote shares for a beneficial owner without timely received voting instructions. The only routine matter to be presented at the annual meetingAnnual Meeting is the proposal to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 20232024 (Proposal Two). The remaining proposal to be considered (Proposal One, the election of Rachel Humphrey, M.D.Santhosh Palani, Ph.D., CFA as a Class I director and Freda Lewis-Hall,John Flavin, Lara Sullivan, M.D. and Thomas CivikJakob Dupont, M.D. as Class IIIII directors) is considered a non-routine matter.

A broker non-vote occurs when a broker, bank or other nominee does not vote on a non-routine matter because the beneficial owner of such shares has not provided voting instructions with regard to such matter. If a broker, bank or other nominee exercise their discretionary voting authority on Proposal Two, such shares will be considered present at the annual meetingAnnual Meeting for quorum purposes and broker non-votes will occur as to Proposal One or any other non-routine matters that are properly presented at the annual meeting.Annual Meeting. Broker non-votes will have no impact on the voting results.

What constitutes a quorum?

The presence at the annual meeting,Annual Meeting, either virtually or by proxy, of holders of a majority of the aggregate number of shares of our issued and outstanding common stock entitled to vote thereat as of the record date shall constitute a quorum for the transaction of business at the annual meeting.Annual Meeting. Abstentions and broker non-votes will be counted as present for the purpose of determining whether a quorum is present at the annual meeting.Annual Meeting.

What vote is required to approve each matter to be considered at the annual meeting?Annual Meeting?

Election of Directors (Proposal One). Our bylaws provide for a plurality voting standard for the election of directors. The directors receiving the highest number of “FOR” votes will be elected as a Class I director and Class IIIII directors. An abstention or a broker non-vote on Proposal One will not have any effect on the election of directors.

Ratification of the Appointment of Ernst & Young LLP as Our Independent Registered Public Accounting Firm for the Fiscal Year Ending December 31, 20232024 (Proposal Two). The affirmative vote of the majority of the shares of our common stock present in person or represented by proxy and entitled to vote on this proposal at the annual meetingAnnual Meeting is required for the approval of Proposal Two. An abstention on Proposal Two will have the same effect as a vote “AGAINST” Proposal Two. Brokers will have discretionary authority to vote on this proposal. Accordingly, there will not be any broker non-votes on Proposal Two.

What is the deadline for submitting a proxy?

To ensure that proxies are received in time to be counted prior to the annual meeting,Annual Meeting, proxies submitted by Internet or by telephone should be received by 11:59 p.m. Eastern Daylight Timethe start of the Annual Meeting unless otherwise provided on the day before the annual meeting, and proxiesInternet Notice, proxy card or voting instruction form. Proxies submitted by mail should be received by the close of business on the day prior to the date of the annual meeting.Annual Meeting.

What does it mean if I receive more than one Internet Notice or proxy card?

If you hold your shares in more than one account, you will receive an Internet Notice or proxy card for each account. To ensure that all of your shares are voted, please complete, sign, date and return a proxy card for each account or use the Internet Notice or proxy card for each account to vote by Internet or by telephone. To ensure that all of your shares are represented at the annual meeting,Annual Meeting, we recommend that you vote every Internet Notice or proxy card that you receive.

4

How will my shares be voted if I return a blank proxy card or a blank voting instruction card?

If you are a holder of record of shares of our common stock and you sign and return a proxy card or otherwise submit a proxy without giving specific voting instructions, your shares will be voted in accordance with the board of director’sBoard's recommendations.

If you hold your shares in street name via a broker, bank or other nominee and do not provide the broker, bank or other nominee with voting instructions (including by signing and returning a blank voting instruction card), your shares:

• | will be counted as present for purposes of establishing a quorum; |

• | will be voted in accordance with the broker’s, bank’s or other nominee’s discretion on “routine” matters, which includes only the proposal to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, |

• | will not be counted in connection with the election of the Class I and Class |

Our board of directorsBoard knows of no mattermatters to be presented at the annual meetingAnnual Meeting other than the proposals described in this proxy statement. If any other matters properly come before the annual meetingAnnual Meeting upon which a vote properly may be taken, shares represented by all proxies received by us will be voted with respect thereto as permitted and in accordance with the judgment of the proxy holders.

Who is making this solicitation and who will pay the expenses?

This proxy solicitation is being made on behalf of our board of directors.Board. All expenses of the solicitation, including the cost of preparing and mailing the Internet Notice or this proxy statement, will be borne by the Company.

Will a stockholder list be available for inspection?

In accordance with Delaware law, a list of stockholders entitled to vote at the annual meetingAnnual Meeting will be available on the annual meetingAnnual Meeting website and, for 10 days prior to the annual meeting,Annual Meeting, at Pyxis Oncology, Inc., 321 Harrison Avenue, Boston, Massachusetts 02118 between the hours of 8:00 a.m. and 5:00 p.m. Eastern Standard Time.

What is “householding” and how does it affect me?

We have adopted a procedure approved by the SEC, called “householding.” Under this procedure, we send only one proxy statement and one annual report to eligible stockholders who share a single address, unless we have received instructions to the contrary from any stockholder at that address. This practice is designed to eliminate duplicate mailings, conserve natural resources, and reduce our printing and mailing costs. Stockholders who participate in householding will continue to receive separate proxy cards.

If you share an address with another stockholder and receive only one set of proxy materials but would like to request a separate copy of these materials, please contact our mailing agent, Broadridge at www.proxyvote.com, by telephone at 1-800-579-1639 or by email at: sendmaterial@proxyvote.com. Similarly, you may also contact Broadridge if you receive multiple copies of the proxy materials and would prefer to receive a single copy in the future. If you own shares through a bank, broker, or other nominee, you should contact the nominee concerning householding procedures.

5

MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING

PROPOSAL ONE:

ELECTION OF ONE CLASS I DIRECTOR AND TWOTHREE CLASS IIIII DIRECTORS

General

Our boardbusiness and affairs are managed under the direction of directors currentlythe Board. The Board presently consists of sixeight directors which areand is divided into three classes for purposes of elections, with staggered, three-year terms. At the annual meeting, our stockholders will elect one Class I director and two Class II directors, with terms that will expire at the annual meeting of stockholders to be held in 2025 and 2026, respectively. Each of our current directors continueswill continue to serve as a director until the election and qualification of his or her successor, or until his or her earlier death, resignation or removal. There are no family relationships among any of our directors or executive officers.

Our board of directorsBoard nominated Rachel Humphrey, M.D.Santhosh Palani, Ph.D., CFA for election to our board of directorsBoard as a Class I director and Freda Lewis-Hall,John Flavin, Lara Sullivan, M.D. and Thomas CivikJakob Dupont, M.D. for election to our board of directorsBoard as Class IIIII directors at the annual meeting.Annual Meeting. Although the term of the Class I directors does not end until our 2025 annual meeting of stockholders, the board of directors,our Board, with Dr. Humphrey’sPalani's agreement, has decided to voluntarily nominate Dr. HumphreyPalani to stand for election at the annual meetingAnnual Meeting for the reminderremainder of herhis term as a Class I director. Dr. Palani is standing for election by our stockholders for the first time and was originally identified as a candidate for director by our Chief Executive Officer.

Dr. Humphrey,Palani, Mr. Flavin, Dr. Lewis-HallSullivan and Mr. CivikDr, Dupont currently serve on our board of directorsBoard and have consented to be named in this proxy statement. Dr. HumphreyPalani has agreed to serve as a director, if elected, until the 2025 annual meeting of stockholders and Mr. Flavin, Dr. Lewis-HallSullivan and Mr. CivikDr. Dupont have agreed to serve as directors, if elected, until the 20262027 annual meeting of stockholders and until their successors have been duly elected and qualified or until their earlier resignation or removal.

Information Regarding Nominee and Continuing Directors

The following table sets forth information with respect to our directors, including the nomineedirector nominees for election at the annual meeting:Annual Meeting:

Name |

|

| Age |

|

|

|

|

|

| ||||||||

|

|

|

|

|

|

| Will Expire | ||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||

| |||||||||||||||||

|

|

|

|

|

|

|

|

|

| ||||||||

| |||||||||||||||||

|

| 41 | Director | March 2024 | Class I - 2024 | ||||||||||||

John Flavin |

|

|

|

| May 2019 | Class III - 2024 | |||||||||||

Lara Sullivan, M.D. | 51 | Director, President and Chief Executive Officer | December 2019 | Class III - 2024 | |||||||||||||

Jakob Dupont, M.D. | 58 | Director | August 2023 | Class III - 2024 | |||||||||||||

Continuing Directors | |||||||||||||||||

Darren Cline | 59 | Director | September 2021 | Class I - 2025 | |||||||||||||

Rachel Humphrey, M.D. | 62 | Director | August 2022 | Class I - 2025 | |||||||||||||

Thomas Civik | 55 | Director | September 2021 | Class II - 2026 | |||||||||||||

Freda Lewis-Hall, M.D. |

|

|

|

|

| September 2021 |

|

|

| ||||||||

|

|

|

|

|

|

|

|

|

| ||||||||

|

|

|

|

|

| ||||||||||||

Class |

|

|

|

|

|

| |||||||||||

|

|

|

|

|

|

|

|

| |||||||||

|

|

|

|

|

|

|

|

|

| ||||||||

Additional biographical descriptions of the nomineenominees and continuing directors are set forth in the text below. These descriptions include the experience, qualifications, qualities and skills that led to the conclusion that each director should serve as a member of our board of directorsBoard at this time.

6

Board Nominees

Class I Director

Rachel Humphrey, M.D. Santhosh Palani, Ph.D., CFA.Dr. HumphreyPalani is a former investment partner and a current advisory partner at PFM Health Sciences, a healthcare investment advisory firm. At PFM, Dr. Palani led public and private biotechnology investments and served on the board of companies in the cell therapy and gene editing fields. Prior to joining PFM in 2020, Dr. Palani was a Principal at New Enterprise Associates, a venture capital financing company, where he invested in early-stage private biotechnology companies and served on the boards of companies in the radiopharmaceuticals, cell therapy, targeted oncology, and gene editing fields. From 2016 to 2018, Dr. Palani was a Vice President of Biotechnology Equity Research at Cowen and Company, where he covered small- to mid-cap biotechnology stocks across numerous therapeutic areas. Prior to his time at Cowen, Dr. Palani was in oncology drug development at Pfizer Inc. (“Pfizer”) and Takeda Pharmaceuticals. Dr. Palani has a Ph.D. in bioengineering from the University of Pennsylvania and completed his postdoctoral work in biochemistry and molecular biophysics at Columbia University. He also holds an M.S. in chemical engineering from Texas A&M University and a B.S. in chemical engineering from the University of Madras. Dr. Palani is a CFA® Charterholder.

The Board believes that Dr. Palani is qualified to serve on our Board based his strong financial and investing background, significant experience in the biotech industry and experience in the fields of internal medicine, endocrinology and oncology.

Class III Directors

John Flavin. Mr. Flavin is co-founder and founding Chair of the Board. Mr. Flavin has served as Chair of the Board since our IPO. He is also the Founder and Chief Executive Officer of Portal Innovations, a life sciences venture development engine. Prior to joining us, between April 2018 and February 2020, Mr. Flavin was the Chief Financial Officer at Endotronix, Inc., a medical oncologist withequipment manufacturer. Between September 2013 and April 2018, Mr. Flavin was the Head of the Polsky Center for Entrepreneurship and Innovation at the University of Chicago. Mr. Flavin has over 2520 years of experience in the pharmaceutical industry. Currently she servesfinance, operations, and innovation. Mr. Flavin has co-founded and scaled several life sciences companies as President and Founding CEOChief Financial Officer such as Advanced Life Sciences and MediChem Life Sciences. Mr. Flavin has also co-founded and led transformative life sciences incubators including MATTER and the Polsky Center for Entrepreneurship and Innovation at the University of Normunity,Chicago. He received his B.S. in Business Administration from Marquette University and his M.B.A. in Finance from Lewis University.

The Board believes that Mr. Flavin is qualified to serve on our Board because of his extensive expertise and experience in the life sciences industry, knowledge of our operations and his leadership experience in other companies in our industry.

Lara Sullivan, M.D. Dr. Sullivan has served as our President and Chief Executive Officer since December 2019. Prior to joining us, Dr. Sullivan was a biotechsenior advisor from July 2018 to September 2019 at Lara Sullivan BioAdvisory Services, consulting for biotechnology companies. From September 2017 to June 2018, Dr. Sullivan was Founder and President of SpringWorks Therapeutics, a clinical stage biopharmaceutical company focusedspun-out from Pfizer. Between February 2011 and September 2017, Dr. Sullivan was at Pfizer, a multinational pharmaceutical and biotechnology corporation, where she led strategy, competitive intelligence and portfolio operations for the company’s early-stage R&D pipeline. Prior to joining Pfizer, Dr. Sullivan was an associate partner at McKinsey & Company, where she specialized in biopharmaceutical R&D productivity and efficiency. Dr. Sullivan also served as a principal at Paul Capital Partners, where she led due diligence for healthcare investments, and earlier in her career worked in healthcare equity research and healthcare municipal finance at Credit Suisse First Boston. Dr. Sullivan holds an M.D. from the University of Pennsylvania School of Medicine, an M.B.A. from The Wharton School at the University of Pennsylvania, and a B.A. in Comparative Literature from Cornell University.

The Board believes that Dr. Sullivan is qualified to serve on immuno-oncology mechanisms,our Board because of her extensive expertise and experience in the life sciences industry, her leadership and management experience and her educational background.

7

Jakob Dupont, M.D. Dr. Dupont served as a position she has held since November 2021. Previously, shemember of the board of directors at Apexigen, Inc. (“Apexigen”) from August 2020 until we completed the acquisition of Apexigen in August 2023. Dr. Dupont currently serves as an Executive Partner at Sofinnova Investments, a healthcare investment firm. Dr. Dupont also serves on the board of directors of Imugene, a biotechnology company. Prior to joining Sofinnova, Dr. Dupont served as the Global Head of Research and Development and Executive Vice President at Atara Biotherapeutics, a biotechnology company, from May 2020 to December 2023. From December 2018 to May 2020, he served as Chief Medical Officer of Black Diamond Therapeutics,and from May 2020 to July 2021 as a novel precision oncology therapy company, from September 2021consultant oncologist at Gossamer Bio Inc., a clinical-stage biopharmaceutical company. From January 2017 to September 2022,December 2018, he served as Vice President, Global Head Breast and Gynecologic Cancer Development at Genentech, a biotechnology company. Dr. Dupont served as Chief Medical Officer at Treadwell Therapeutics, Inc., a clinical stage, multi-modality oncology company, from January 2020 to May 2020 and Head of Research and Development of TIO Bioventures, a venture capital firm, over the same time period. Prior to those positions, Dr. Humphrey served as Senior Vice President Chief Medical Officer at CytomX Therapeutics,OncoMed Pharmaceuticals, a clinical-stage biopharmaceuticalbiotechnology company, from August 2015October 2011 to September 2019. OverDecember 2016. Dr. Dupont holds an A.B. in Philosophy from Vassar College, an M.A. in Philosophy from New York University and an M.D. from Cornell University.

The Board believes that Dr. Dupont is qualified to serve on our Board because of his extensive experience in the course of her career, she’s also held numerous senior leadership rolesbiotechnology field and his knowledge and expertise in large pharmaceutical companies including SVP and Head of Immuno-Oncology at AstraZeneca, and VP, Clinical Development and Immuno-oncology at Bristol-Myers Squibb (BMS) where she supervised the development of ipilimumab (Yervoy) from early development to post-launch and founded/chaired the first Immuno-oncology working group. Sheoncology drug development.

Continuing Directors – Class I Directors

Darren Cline. Mr. Cline currently serves on the board of directors of Sporos Biosciences, and previously served on the board of directors of Xilio and CytomXPliant Therapeutics, respectively. Dr. Humphrey holds an M.D. from Case Western Reserve University and a B.A. from Harvard University. She received her training in internal medicine at The Johns Hopkins Hospital and started her career as an oncology fellow and staff physician at the National Cancer Institute in Bethesda, Maryland.

The board of directors believes that Dr. Humphrey is qualified to serve on our board of directors based on her expertise and experience in the life sciences industry and her leadership experience as a senior executive at various biopharmaceutical companies as well as her educational background.

Class II Directors

Freda Lewis-Hall, M.D. Dr. Lewis-Hall served as Senior Medical Advisor to the Chief Executive Officer at Pfizer Inc., a pharmaceutical and biotechnology corporation, until her retirement in March 2020. Prior to that, she was the Chief Patient Officer and Executive Vice President at Pfizer from January 2019 to January 2020. In this role, Freda worked to extend the reach of Pfizer’s patient-facing health information and education and amplify the patient’s voice inside and outside Pfizer. From 2009-2018 Freda served as Pfizer’s Chief Medical Officer, responsible for the safe, effective and appropriate use of Pfizer medicines and vaccines. From 2009 to January 2019, Dr. Lewis-Hall served as Pfizer’s Chief Medical Officer. Prior to joining Pfizer in 2009, Dr. Lewis-Hall held various senior leadership positions including Chief Medical Officer and Executive Vice President, Medicines Development at Vertex Pharmaceuticals, Inc., from June 2008 to May 2009, and Senior Vice President, U.S. Pharmaceuticals, Medical Affairs for Bristol-Myers Squibb Co. from 2003 to May 2008. Dr. Lewis-Hall has served on the board of directors of Exact Sciences Corporation, since 2020, 1Life Healthcare, Inc., since November 2019, and SpringWorks Therapeutics, Inc., since August 2017. From December 2014 to May 2017, she served on the board of directors of Tenet Healthcare Corporation, a healthcare services company. Dr. Lewis-Hall earned a B.A. in Natural Sciences from Johns Hopkins University and a M.D. from Howard University College of Medicine.

The board of directors believes that Dr. Lewis-Hall is qualified to serve on our board of directors based on her expertise and experience in the life sciences industry and her leadership experience as a senior executive at various biopharmaceutical companies as well as her educational background.

Thomas Civik. From April 2020 to May 2021, Mr. Civik served as President, Chief Executive Officer and a member of the board of directors at Five Prime Therapeutics, Inc., a biotechnology company. From November 2017 until September 2019, Mr. Civik served as Chief Commercial Officer of Foundation Medicine, Inc.,company, and Impel Pharmaceuticals, a genomic profiling and molecular informationbiopharmaceutical company. From December 2000 to November 2017, Mr. Civik served in positions of increasing responsibility at Genentech, Inc. ("Genentech"), most recently serving as Vice President and Franchise Head leading the commercialization efforts for the Avastin®, Tarceva®, Tecentriq®, and Alecensa®, products. From July 1992 to December 2000, he served at Sanofi S.A. in sales and marketing roles of increasing responsibility. Mr. Civik currently serves on the board of directors of Repare Therapeutics. Mr. Civik received a M.B.A. in business strategy and marketing from the Kellogg School of Management at Northwestern University and a B.A. in political science from Saint Norbert College.

The board of directors believes that Mr. Civik is qualified to serve on our board of directors because of his extensive commercial expertise and leadership experience at other biotechnology companies.

Continuing Directors – Class I Director

Darren Cline. Mr. Cline served as President and Chief Executive Officer of Epygenix Therapeutics, Inc., a biopharmaceutical company, from March 2022 to March 2023. PriorFrom April 2019 to this, heDecember 2021, Mr. Cline served as the U.S. Chief Commercial Officer and member of the Executive Committee for Greenwich Bioscience, the U.S. subsidiary of GW Pharmaceuticals, a British pharmaceuticspharmaceutical company, starting in April 2019 through December 2021. Betweenprior to the acquisition by Jazz Pharmaceuticals. From October 2010 andto March 2019, Mr. Cline served as Executive Vice President, Commercial at Seattle Genetics, Inc., a biotechnology company, where he oversaw all marketing, sales, and managed markets. He was directly involved in the commercial build out for the launch of Adcetris, an antibody-based biologic the FDA approved for treatment of certain hematologic cancers and played an integral role driving Adcetris’s continued growth. Prior to Seattle Genetics, between October 2006 and October 2009, Mr. Cline was at Alexion Pharmaceuticals, where he was part of the initial commercial leadership team for the Soliris launch, helping to build out key sales functions. Mr. Cline currently serves on the board of directors of Pliant Therapeutics and Impel Pharmaceuticals. Mr. Cline received his undergraduate degree from San Diego State University and his M.B.A. from Pepperdine University.

The board of directorsBoard believes that Mr. Cline is qualified to serve on our board of directorsBoard because of his management experience and background in the biotechnology sector.

Continuing Directors – Class III Directors

John FlavinRachel Humphrey, M.D. . Mr. FlavinDr. Humphrey is one of our co-founders, founding Chairman and an independent director. John has served as Chairman of our board of directors since our initial public offering. He is also the Founder and CEO of Portal Innovations, a life sciences venture development engine. Prior to joining us, between April 2018 and February 2020, John was the Chief Financial Officer at Endotronix, Inc., a medical equipment manufacturer. Between September 2013 and April 2018, John was the Head of the Polsky Center for Entrepreneurship and Innovation at the University of Chicago. John hasoncologist with over 2025 years of experience in finance, operations, and innovation. John has co-founded and scaled several life sciences companiesthe pharmaceutical industry. Currently she serves as President and CFO suchFounding CEO of Normunity, a biotechnology company focused on immuno-oncology mechanisms, a position she has held since October 2021. Previously, she served as Advanced Life SciencesChief Medical Officer at Black Diamond Therapeutics, a novel precision oncology therapy company, from September 2021 to September 2022, and MediChem Life Sciences. Mr. Flavin hasas Chief Medical Officer at Treadwell Therapeutics, Inc., a clinical stage, multi-modality oncology company, from January 2020 to May 2020 and Head of Research and Development at TIO Bioventures, a venture capital firm, over the same time period. Dr. Humphrey served as Senior Vice President, Chief Medical Officer at CytomX Therapeutics, a clinical-stage biopharmaceutical company, from August 2015 to September 2019. Over the course of her career, Dr. Humphrey also co-foundedheld numerous senior leadership roles in large pharmaceutical companies including Senior Vice President and led transformative life sciences incubators including MATTERHead of Immuno-Oncology at AstraZeneca, and Vice President, Clinical Development and Immuno-oncology at Bristol-Myers Squibb where she supervised the Polsky Center for Entrepreneurshipdevelopment of ipilimumab (Yervoy) from early development to post-launch and Innovation atfounded and chaired the University of Chicago. He received his B.S. in Business Administration from Marquette University and his M.B.A. in Finance from Lewis University.

Thefirst immuno-oncology working group. She currently serves on the board of directors of Sporos Biosciences, and previously served on the board of directors of Xilio and CytomX Therapeutics, respectively. Dr. Humphrey holds an M.D. from Case Western Reserve University and a B.A. from Harvard University. She received her training in internal medicine at the Johns Hopkins Hospital and started her career as an oncology fellow and staff physician at the National Cancer Institute in Bethesda, Maryland.

The Board believes that Mr. FlavinDr. Humphrey is qualified to serve on our board of directors because of his extensiveBoard based on her expertise and experience in the life sciences industry knowledge of our operations and hisher leadership experience in otheras a senior executive at various biopharmaceutical companies in our industry.as well as her educational background.

8

Continuing Directors – Class II Directors

Lara Sullivan, M.D.Thomas Civik has. Mr. Civik currently serves a member and Chairman of the board of directors of Repare Therapeutics, a biotechnology company. From April 2020 to May 2021, Mr. Civik served as President, and Chief Executive Officer and a member of Pyxis Oncology since December 2019. Prior to joining us, Dr. Sullivan wasthe board of directors at Five Prime Therapeutics, Inc., a senior advisor from July 2018 tobiotechnology company. From November 2017 until September 2019, Mr. Civik served as Chief Commercial Officer of Foundation Medicine, Inc., a genomic profiling and molecular information company. From December 2000 to November 2017, Mr. Civik served in positions of increasing responsibility at Lara Sullivan BioAdvisory Services, consulting forGenentech, Inc. (“Genentech”), a biotechnology companies. From September 2017 to June 2018, Dr. Sullivan was Foundercompany, most recently serving as Vice President and President of SpringWorks Therapeutics, a clinical stage biopharmaceutical company spun-out from Pfizer. Between February 2011 and September 2017, Dr. Sullivan was at Pfizer, where she led strategy, competitive intelligence and portfolio operationsFranchise Head leading the commercialization efforts for the company’s early-stage R&D pipeline. PriorAvastin®, Tarceva®, Tecentriq®, and Alecensa®, products. From July 1992 to joining Pfizer, Dr. Sullivan wasDecember 2000, Mr. Civik served at Sanofi S.A. in sales and marketing roles of increasing responsibility. Mr. Civik received an associate partner at McKinsey & Company, where she specializedM.B.A. in biopharmaceutical R&D productivitybusiness strategy and efficiency. Dr. Sullivan also served as a principal at Paul Capital Partners, where she led due diligence for healthcare investments, and earlier in her career worked in healthcare equity research and healthcare municipal finance at Credit Suisse First Boston. Lara holds a M.D.marketing from the University of PennsylvaniaKellogg School of Medicine, a M.B.A. from The Wharton SchoolManagement at theNorthwestern University of Pennsylvania, and a B.A. in Comparative Literaturepolitical science from Cornell University.Saint Norbert College.

The board of directorsBoard believes that Dr. SullivanMr. Civik is qualified to serve on our Board because of his extensive commercial expertise and leadership experience at other biotechnology companies.

Freda Lewis-Hall, M.D. Dr. Lewis-Hall served as Senior Medical Advisor to the Chief Executive Officer at Pfizer, a pharmaceutical and biotechnology corporation, until her retirement in March 2020. Prior to this role, Dr. Lewis-Hall was the Chief Patient Officer and Executive Vice President at Pfizer, a multinational pharmaceutical and biotechnology corporation, from January 2019 to January 2020. In this role, Freda worked to extend the reach of Pfizer’s patient-facing health information and education and amplify the patient’s voice inside and outside Pfizer. From 2009-2018 Freda served as Pfizer’s Chief Medical Officer, responsible for the safe, effective and appropriate use of Pfizer medicines and vaccines. Prior to joining Pfizer in 2009, Dr. Lewis-Hall held various senior leadership positions including Chief Medical Officer and Executive Vice President, Medicines Development at Vertex Pharmaceuticals, Inc., from June 2008 to May 2009, and Senior Vice President, U.S. Pharmaceuticals, Medical Affairs for Bristol-Myers Squibb Co. from 2003 to May 2008. Dr. Lewis-Hall has served on the board of directors because of SpringWorks Therapeutics, Inc. since August 2017, Exact Sciences Corporation since November 2020 and Conduit Pharmaceuticals since September 2023. From December 2014 to May 2017, she served on the board of directors of Tenet Healthcare Corporation, and from November 2019 to 2023 on the board of 1Life Healthcare, Inc. Dr. Lewis-Hall earned a B.A. in Natural Sciences from Johns Hopkins University and an M.D. from Howard University College of Medicine.

The Board believes that Dr. Lewis-Hall is qualified to serve on our Board based on her extensive expertise and experience in the life sciences industry and her leadership and management experience andas a senior executive at various biopharmaceutical companies as well as her educational background.

Recommendation of Our Board of Directors

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF RACHEL HUMPHREY, M.D.SANTHOSH PALANI, PH.D., CFA AS CLASS I DIRECTOR AND FREDA LEWIS-HALL,JOHN FLAVIN, LARA SULLIVAN, M.D. AND THOMAS CIVIKJAKOB DUPONT, M.D. AS CLASS IIIII DIRECTORS.

9

CORPORATE GOVERNANCE

Director Independence

UnderAs our common stock is listed on the rulesNasdaq, the Company's determination of Nasdaq, independent directors must comprise a majority of a listed company’s boardthe independence of directors within a specified period afterand director nominees is premised on the completiondefinition of its initial public offering.“independent director” contained in Nasdaq Rule 5605(a)(2). In addition, the rules of Nasdaq require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and governance committees be independent. A director will only qualify as an “independent director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Additionally, compensation committee members and audit committee members must satisfy additional independence criteria under Nasdaq and SEC rules.

Our board of directorsBoard has undertaken a review of the independence of each director and director nominee and has considered whether each directorany of the foregoing has a material relationship with usthe Company that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. As a result of this review, our board of directorsBoard determined that, with the exception of our President and Chief Executive Officer, LaraDr. Sullivan, M.D., each member of our board of directorsBoard and each director nominee is an “independent director” as defined under the applicable rules and regulations of the SEC and the listing requirements and rules of Nasdaq. In addition, Mark Chin, who served on the board of the directors during a portion of 2022, was also independent. In making these determinations, our board of directorsBoard reviewed and discussed information provided by the directors and by usdirector nominees with regard to each director’s or director nominee's business and personal activities and relationships as they may relate to us and our management, including the beneficial ownership of our common stock by each non-employee director and the transactions involving themsuch non-employee directors described in the section titled “Certain Relationships and Related Party Transactions.”Transactions”.

Leadership Structure of the Board of Directors

Our bylaws and corporate governance guidelines provide our board of directorsBoard with flexibility to combine or separate the positions of Chairperson of the board of directorsBoard and Chief Executive Officer and/or the implementation of a lead director in accordance with its determination that utilizing one or the other structure would be in the best interests of our Company.company. Mr. John Flavin currently serves as our ChairmanChair of the board of directors.Board.

As a general policy, our board of directorsBoard believes that separation of the positions of ChairmanChairperson of the board of directorsBoard and Chief Executive Officer reinforces the independence of ourthe board of directors from management, creates an environment that encourages objective oversight of management’s performance and enhances the effectiveness of our board of directorsthe Board as a whole. As such, Dr. Lara Sullivan serves as our President and Chief Executive Officer while Mr. John Flavin serves as our ChairmanChair of the board of directorsBoard but is not an officer of our Company. Our board of directorscompany. The Board has concluded that our current leadership structure is appropriate at this time. However, our board of directorsBoard continues to periodically review our leadership structure and may make such changes in the future as it deems appropriate.

Board of Directors’ Role in Risk Oversight

One of the key functions of our board of directorsthe Board is informed oversight of our risk management process. The board of directorsOur Board does not have a standing risk management committee, but rather administers this oversight function directly through the board of directors as a whole, as well as through its standing committees that address risks inherent in their respective areas of oversight. In particular, our board of directorsthe Board is responsible for monitoring and assessing strategic risk exposure. Our audit committeeAudit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The auditOur Audit committee also oversees and continuously monitors our cybersecurity risk profile and assesses potential risk exposure. For more information on our management of cybersecurity risks, please refer to Item 1C, “Cybersecurity,” in our Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on March 21, 2024. Our Audit Committee also monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of our external audit function. Our nominatingNominating and corporate governance committeeCorporate Governance Committee monitors the effectiveness of our corporate governance guidelines and risks associated with our governance practices, including those related to emerging topics such as human capital analysis and disclosures and the Company’sour environmental, sustainability and governance efforts, progress and disclosures. Our compensation committeeCompensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking.

Regarding cybersecurity, Our Research & Development Committee provides guidance to management and the board of directors is briefed by managementBoard on cybersecurity matters impacting the Company at least twice a year. Throughout 2022, management worked extensively with external consultantsrelating to evaluate the Company’s cybersecurity incident response planning frameworkour research and to develop an enterprise-wide incident response plan to be deployed in the event of,development efforts and to help mitigate the impact of a cybersecurity incident. The Board was actively engaged in this endeavor and received periodic updates and reports concerning the Company’s progress.product pipeline.

10

Evaluation of the Board of Directors

The board of directorsBoard evaluates its performance and the performance of its committees and individual directors on an annual basis through an evaluation process administered by the nominatingNominating and corporate governance committee.Corporate Governance Committee. The board of directorsBoard discusses each evaluation to determine what, if any, actions should be taken to improve the effectiveness of the board of directorsBoard or any committee thereof or of the directors.

Board Diversity Matrix

The table below provides information regarding certain diversity attributes of our directors as of April 28, 2023,26, 2024, with categories as set forth by Nasdaq Listing Rule 5605(f).

Board Diversity Matrix | Board Diversity Matrix | Board Diversity Matrix | ||||||||||||

Total Number of Directors: 6 | ||||||||||||||

Total Number of Directors: 8 | Total Number of Directors: 8 | |||||||||||||

|

| Female |

| Male |

| Non Binary |

| Did Not Disclose Gender | Female | Male | ||||

Part I: Gender Identity |

|

|

|

|

|

| ||||||||

Directors |

| 3 |

| 3 |

| - |

| - | 3 | 5 | ||||

Part II: Demographic Background |

|

|

|

|

|

| ||||||||

African American or Black |

| 1 |

| - |

| - |

| - | 1 | — | ||||

Alaskan Native or Native American | | - | | - | | - | | - | ||||||

Asian | | - | | - | | - | | - | | — | | 1 | ||

Hispanic or Latinx | | - | | - | | - | | - | ||||||

Native Hawaiian or Pacific Islander | | - | | - | | - | | - | ||||||

White | | 2 |

| 3 |

| - | | - | | 2 | 4 | |||

Two or More Races or Ethnicities | | - | | - | | - | | - | ||||||

LGBTQ+ | | - | | - | | - | | - | ||||||

Did Not Disclose Demographic Background |

| - |

| - |

| - |

| - | ||||||

Meetings of the BoardAttendance of Directors at Board Meetings and Stockholder Meetings

Our board of directorsBoard held fourteenten meetings during the year ended December 31, 2022.2023. During 2022,2023, each person currently serving as a director attended 75% or more of the total number of meetings of the board of directorsBoard and each committee of which he or she was a member. Each director is also encouraged and expected to attend the Company’sour annual meeting.meetings of stockholders.

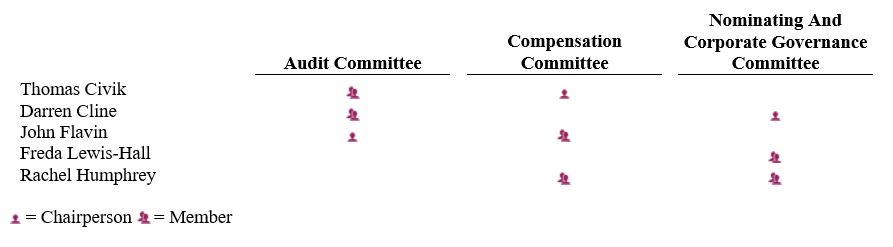

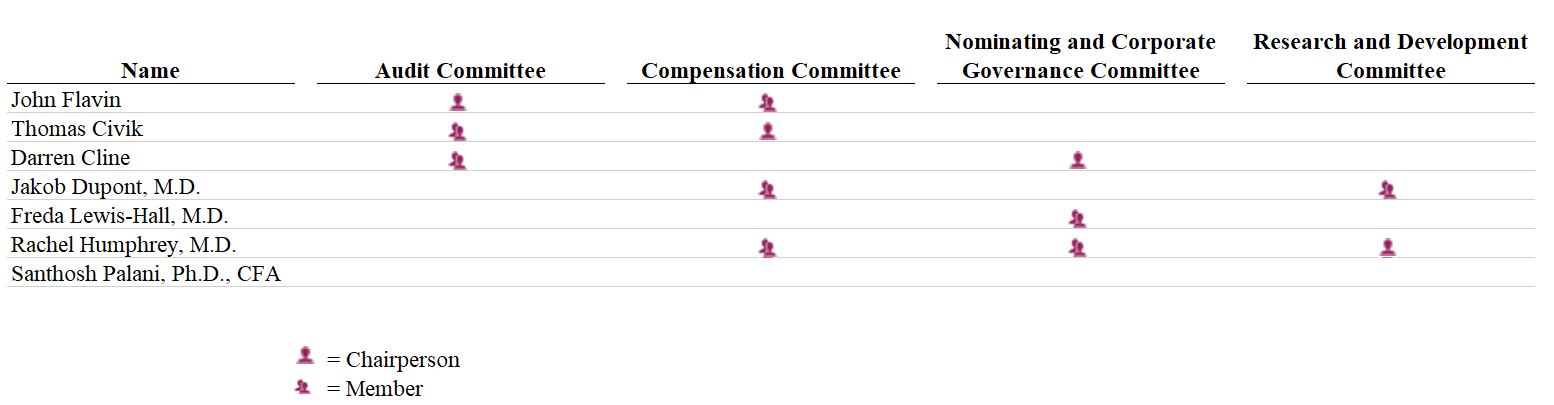

Committees of the Board of Directors

Our board of directorsThe Board has established threefour standing committees: audit committee, compensation committeeAudit Committee, Compensation Committee, Nominating and nominatingCorporate Governance Committee and corporate governance committee.Research and Development Committee. Each committee operates pursuant to a written charter that has been approved by our board of directors.the Board. A copy of the current charter for each of the audit committee, compensation committee and nominating and corporate governance committee is available on our website at www.pyxisoncology.com by selecting the “Investors” link and then the “Corporate Governance” link.

The audit committeeAudit Committee met six times in 2022,2023, the compensation committeeCompensation Committee met nineeight times in 20222023, the Nominating and Corporate Governance Committee met three times in 2023 and the nominating and corporate governance committeeResearch & Development Committee met one timefour times in 2022.2023.

Committee Composition

Dr. Palani is not yet appointed to any of the Board committees and may join any of the above committees in future, as deemed appropriate by the Board based on the recommendation of our Nominating and Corporate Governance Committee.

11

Audit Committee

Our board of directors has an audit committeeAudit Committee oversees our corporate accounting and our board of directors has adopted an audit committeefinancial reporting processes. The Audit Committee charter which defines the audit committee’s principal functions, including oversight related to:responsibilities of the Audit Committee, including:

• | overseeing our corporate accounting and financial reporting processes and our internal controls over financial reporting; |

• | evaluating the independent public accounting firm’s qualifications, independence and performance; |

• | engaging and providing for the compensation of the independent public accounting firm; |

• | pre-approving audit and permitted non-audit and tax services to be provided to us by the independent public accounting firm; |

• | reviewing and discussing with management and the independent auditor the results of the annual audit and the independent auditor’s review of our quarterly financial statements |

• | reviewing our financial statements; |

• | reviewing our critical accounting policies and |

• | establishing procedures for complaints received by us regarding accounting, internal accounting controls or auditing matters, including for the confidential anonymous submission of concerns by our employees, and periodically reviewing such procedures, as well as any significant complaints received, with management; |

• |

|

|

|

• | overseeing our risk assessment and risk management policies and programs, including our code of business conduct and ethics and our compliance activities; |

• | overseeing cybersecurity, including measures to protect and improve our informational technology systems, and monitoring cybersecurity and data privacy risks associated with our activities and those of third parties we work with; and |

• | such other matters that are specifically designated to the |

Our boardThe Audit Committee has been established in accordance with Section 3(a)(58)(A) of directorsthe Exchange Act of 1934 (“Exchange Act”). Mr. Flavin has served as Chair of the Audit Committee since May 2019. The other members of our Audit Committee are Mr. Civik and Mr. Cline. The Board has determined that each member of our audit committeeAudit Committee is independent within the meaning of Rule 10A-3 under the Securities Exchange Act of 1934 (the “Exchange Act”).Act. Our board of directorsBoard has also determined that Mr. Flavin is an “audit committee financial expert” as defined by the applicable SEC rules and has the requisite accounting or related financial management expertise and financial sophistication under the applicable rules and regulations of Nasdaq.

Compensation Committee

Our board of directors has aCompensation Committee oversees our compensation committeepolicies, plans and our board of directors has adopted a compensation committeebenefits program. The Compensation Committee charter which defines the compensation committee’s principal functions,responsibilities of the Compensation Committee, including:

• | reviewing and recommending policies relating to compensation and benefits of our officers and employees, including reviewing and approving corporate goals and objectives relevant to compensation of the Chief Executive Officer and other senior officers; |

• | evaluating the performance of the Chief Executive Officer and other senior officers in light of |

• | setting compensation of the Chief Executive Officer and other senior officers based on such evaluations; |

• | administering the issuance of |

• | reviewing and approving, for the Chief Executive Officer and other senior officers, employment agreements, severance agreements, consulting agreements and change in control or termination agreements; and |

• | such other matters that are specifically designated to the |

12

Our board of directorsBoard has determined that each member of our compensation committeethe Compensation Committee is independent under the Nasdaq listing standards and is a “non-employee director” as defined in Rule 16b-3 promulgated under the Exchange Act.

Research and Development Committee

Our Research and Development Committee provides guidance to management and the Board on matters relating to our research and development efforts and product pipeline. The Research and Development Committee charter defines the responsibilities of the Research and Development Committee, including:

• | evaluating risks associated with our preclinical studies, clinical trials and clinical development; |

• | reviewing our overall scientific, research and development strategy; |

• | assessing each of our program's and product candidates' progress; |

• | summarizing significant findings of our research and development efforts and product pipeline to the Board; and |

• | reviewing and advising the Board on the scientific, medical, research and development aspects of any proposed material transactions. |

Nominating and Corporate Governance Committee

Our board of directors has a nominatingNominating and corporate governance committeeCorporate Governance Committee oversees and our board of directors has adopted a nominatingassists the Board in evaluating and corporate governance committee charter. Specificrecommending nominees for election as directors. The Nominating and Corporate Governance Committee charter defines the responsibilities of our nominatingthe Nominating and corporate governance committee include:Corporate Governance Committee, including:

• | identifying and evaluating candidates, including the nomination of incumbent directors for re-election and nominees recommended by stockholders, to serve on |

• | considering and making recommendations to |

• | instituting plans or programs for the continuing education of |

• | establishing procedures to exercise oversight of, and oversee the performance evaluation process of, |

• | developing and making recommendations to |

• | overseeing periodic evaluations of the |

Our board of directorsBoard has determined that each member of our nominatingNominating and corporate governance committeeCorporate Governance Committee is independent under the applicable Nasdaq listing standards.

Our Nominating and Corporate Governance Committee also oversees compliance by the Company with respect to certain legal and regulatory obligations applicable to the Company and periodically reviews Company policies and procedures, including:

• | Corporate Disclosure Policy; |

• | Code of Business Conduct and Ethics; |

• | Insider Trading Policy; |

• | Clawback Policy; |

• | Related Persons Transaction Policy; |

• | independence of our directors; |

• | amended and restated certificate of incorporation; and |

13

amended and restated bylaws.

Board Membership Criteria and Nomination Process

The board of directorsBoard and the nominatingNominating and corporate governance committeeCorporate Governance Committee will determine the appropriate characteristics, skills and experience for the board of directors as a whole and for its individual members. The board of directorsBoard and the nominatingNominating and corporate governance committeeCorporate Governance Committee will consider the minimum general criteria set forth below, and may add any specific additional criteria with respect to specific searches, in selecting candidates and existing directors for service on the board of directors.Board. An acceptable candidate may not fully satisfy all of the criteria, but is expected to satisfy nearly all of them. The board of directorsOur Board and the nominatingour Nominating and corporate governance committeeCorporate Governance Committee believe that candidates for director should have certain minimum qualifications, including being able to read and understand basic financial statements, being over 21 years of age and having the highest personal integrity and ethics.

In considering candidates, the board of directorsour Board and the nominatingNominating and corporate governance committeeCorporate Governance Committee intend to consider such factors as possessing relevant expertise upon which to be able to offer advice and guidance to management, having sufficient time to devote to the affairs of Pyxis Oncology, demonstrated excellence in his or her field, having the ability to exercise sound business judgment and having the commitment to rigorously represent the long-term interests of our stockholders. The board of directorsOur Board and the nominatingNominating and corporate governance committeeCorporate Governance Committee review candidates for director nomination in the context of the current composition of the board of directors,Board, the operating requirements of Pyxis Oncology and the long-term interests of our stockholders. In conducting this assessment, the board of directorsour Board and the nominatingNominating and corporate governance committeeCorporate Governance Committee consider diversity (including race/ethnicity and gender), age, skills, and such other factors as it deems appropriate given the current needs of the board of directorsBoard and Pyxis Oncology to maintain a balance of knowledge, experience and capability.

In the case of incumbent directors whose terms of office are set to expire, the board of directorsour Board and the nominatingNominating and corporate governance committeeCorporate Governance Committee review such directors’ overall service to Pyxis Oncology during their term, including the number of meetings attended, level of participation, quality of performance, and any other relationships and transactions that might impair such directors’ independence. In the case of new director candidates, the board of directorsour Board and the nominatingNominating and corporate governance committeeCorporate Governance Committee also determine whether the nominee must be independent for purposes of any stock exchange on which any of Pyxis Oncology’s capitalcommon stock is listed.

The nominatingOur Nominating and governance committeeCorporate Governance Committee will consider director candidates recommended by our stockholders and will apply the same standards in considering director candidates recommended by stockholders as it applies to other candidates. Once the nominatingNominating and governance committeeCorporate Governance Committee receives a recommendation from a stockholder, it may request additional information from the candidate about the candidate’s independence, qualifications and other information that would assist the committee in evaluating the candidate, as well as certain information that must be disclosed about the candidate in the Company’sour proxy statement, if nominated.

Stockholders may also directly nominate a candidate for director by submitting the candidate's name and relevant information to c/o Corporate Secretary, Pyxis Oncology, Inc., 321 Harrison Avenue, Boston, Massachusetts 02118, pursuant to the advance notice provisions of our bylaws. For more information, please see the section entitledtitled “Stockholder Proposals and Nominations”.Nominations.”

Changes in Board of Directors Member Criteria

The board of directorsBoard and Pyxis Oncology wish to maintain a board of directors composed of members who can productively contribute to the success of Pyxis Oncology. From time to time, the board of directorsBoard and/or the nominatingNominating and corporate governance committeeCorporate Governance Committee may change the criteria for board of directorsdirector membership to maximize the opportunity to achieve this success. When this occurs, the board of directorsBoard and the nominatingNominating and corporate governance committeeCorporate Governance Committee will evaluate existing members according to the new criteria. The board of directorsBoard may ask a director who no longer meets the complete criteria for board membership to adjust his or her committee assignments or resign from the board of directors.Board.

Term Limits and Retirement Age

The board of directorsBoard does not believe it should limit the number of terms for which an individual may serve as a director or set a fixed retirement age. Directors who have served on the board of directorsBoard for an extended period of time are able to provide continuity and valuable insight into Pyxis Oncology, our operations and prospects based on their experience with, and understanding of, our history, policies and objectives. The board of directorsBoard believes that, as an alternative to term limits and retirement policies, it can ensure that the board of directorsBoard continues to evolve and adopt new ideas and viewpoints through the director nomination process described above.

14

Succession Planning

The nominatingNominating and corporate governance committeeCorporate Governance Committee develops and periodically reviews with the Chief Executive Officer our plan for succession to the offices of our executive officers and makes recommendations to the board of directorsBoard with respect to the selection of appropriate individuals to succeed to these positions.

Compensation Committee Interlocks and Insider Participation

During the year ended December 31, 2022,2023, none of the members of our compensation committeeCompensation Committee were or had been an officer or employee of us or any of our subsidiaries. In addition, none of our executive officers serves or has served as a member of the board of directors, compensation committee or other board committee performing equivalent functions of any entity that has one or more executive officers serving as one of our directors or on our compensation committee.Compensation Committee.

Corporate Governance Guidelines

The board of directorsBoard has adopted our Corporate Governance Guidelines which provide the framework for our corporate governance along with our amended and restated certificate of incorporation, bylaws, committee charters and other key governance practices and policies. Our Corporate Governance Guidelines cover a wide range of subjects, including the conduct of board meetings, independence and selection of directors, board membership criteria and board committee composition. The Corporate Governance Guidelines are available on our website at www.pyxisoncology.com by selecting the “Investors” link and then the “Corporate Governance” link.www.pyxisoncology.com.

Code of Business Conduct and Ethics

We have adopted a codeCode of conduct applicableBusiness Conduct and Ethics that applies to our principal executive, financialdirectors and accounting officers and all persons performing similar functions. Our code of conductemployees. The policy document is available on our principal corporate website at www.pyxisoncology.com.

Prohibition on Hedging and Pledging of Company Securities

The Company hasWe have a policy that prohibits officers, directors and employees from engaging in hedging transactions, such as the purchase or sale of puts or calls, or the use of any other derivative instruments. Officers,Our officers, directors and employees of the Company are also prohibited from holding Companyour securities in a margin account or pledging Companyour securities as collateral for a loan.

Stockholder Communications

Any stockholder or other interested party who wishes to communicate with our board of directorsBoard or any individual director may send written communications to our board of directorsBoard or such director c/o Corporate Secretary, Pyxis Oncology, Inc., 321 Harrison Avenue, Boston Massachusetts 02118. The communication must include the stockholder’s name, address and an indication that the person is our stockholder. The Corporate Secretary will review any communications received from stockholders and will forward such communications to the appropriate director or directors, or committee of our board of directors,Board, based on the subject matter.

15

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS

Our audit committeeAudit Committee has the primary responsibility for the review approval and oversightapproval of any “related person transaction,” which is any transaction, arrangement or relationship (or series of similar transactions, arrangements or relationships) in which we are, were or will be a participant and the amount involved exceeds $120,000, and in which the related person has, had or will have a direct or indirect material interest. We have adopted a formal, written related party transaction policy in connection with our initial public offering. Under our related party transaction policy, our management will be required to submit anywhich sets forth the policies and procedures for the review and approval or ratification of related person transaction not previously approved or ratified by our audit committee to our audit committee. In approving or rejecting the proposed transactions, our audit committeeAudit Committee. The Audit Committee will take into accountconsider all of the relevant facts and circumstances, available.including but not limited to whether the transaction is on terms comparable to those that could be obtained in an arm’s length transaction with an unrelated third party and the extent of the related person’s interest in the transaction.

A related person transaction does not include the compensation arrangements with our directors and executive officers that are described elsewhere in this proxy statement. The related party transactions described below reflect all such transactions since January 1, 2021,2022, and have all been approved pursuant to the Company’sour existing related party transaction policy.

Series B Convertible Preferred Stock Financing

In March 2021, we issued a total of 104,812,248 shares of our Series B Convertible Preferred Stock for $1.6458 per share. 92,356,299 of the shares were issued to new and existing stockholders generating $151.6 million in proceeds, net of issuance costs, 12,152,145 shares were issued to Pfizer, Inc. (“Pfizer”) as part of the $20.0 million license expenses under the a license agreement, as amended, (the “Pfizer License Agreement”) for worldwide development and commercialization rights to two of Pfizer’s proprietary ADC product candidates (now referred to as PYX-201 and PYX-203), as well as other ADC product candidates directed to the licensed targets and 303,804 shares were issued to LegoChem Biosciences, Inc. (“LegoChem”) as part of the $0.5 million research and development expenses under the opt-in, investment and additional consideration agreement with LegoChem (the “Opt-In Agreement”). Each 6.359 shares of Series B Convertible Preferred Stock was automatically converted into one share of common stock upon the completion of our initial public offering.

The participants in the Series B Convertible Preferred Stock financing included certain beneficial owners of more than 5% of our capital stock and entities affiliated with certain of our directors, as set forth in the table below:

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amended and Restated Investor Rights Agreement